Cracking the Code: How Ecommerce Fraud Prevention Software Works

Ecommerce has revolutionized the way we shop, offering convenience and endless options at our fingertips. However, with the rise of online transactions, the threat of fraud looms large. To protect both merchants and customers, advanced technology comes into play. In this article, we will delve into the fascinating world of ecommerce fraud prevention software, exploring its mechanisms, benefits, and how it keeps fraudulent activities at bay.

Understanding Ecommerce Fraud

Ecommerce fraud refers to any deceitful or illegal activities conducted during online transactions, aiming to exploit merchants, consumers, or payment processors. This includes identity theft, credit card fraud, chargebacks, and account takeovers. Ecommerce fraud poses significant financial risks and damages the trust between businesses and customers, which is why robust fraud prevention measures are crucial.

The Role of Fraud Prevention Software

Fraud prevention software acts as a vital line of defense against ecommerce fraud. It employs sophisticated algorithms and machine learning models to analyze transactional data, identify patterns, and detect suspicious activities in real-time. By flagging potentially fraudulent transactions, this software enables businesses to take prompt action, minimizing losses and safeguarding their reputation.

Outdoor pond pumps come in various types, including submersible, external, fountain, solar, and aerating pumps, each serving different purposes for maintaining a healthy and beautiful pond ecosystem.

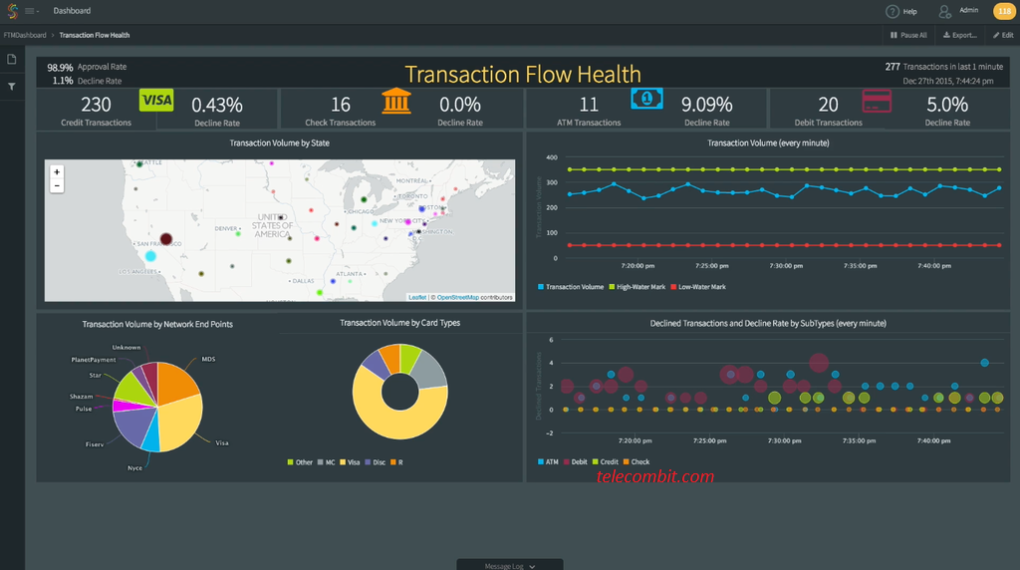

Real-Time Transaction Monitoring

One of the key features of ecommerce fraud prevention software is real-time transaction monitoring. Every online transaction is closely scrutinized, evaluating multiple data points such as IP addresses, device information, transaction history, and behavioral patterns. By assessing these variables, the software can quickly identify anomalies and potentially fraudulent activities, allowing for immediate intervention.

Machine Learning and Artificial Intelligence

Machine learning and artificial intelligence (AI) play a pivotal role in ecommerce fraud prevention software. These technologies continuously learn from vast amounts of data, adapting and improving their fraud detection capabilities over time. As fraudsters evolve their tactics, machine learning algorithms evolve as well, ensuring that the software stays ahead of emerging threats.

User Behavior Analysis

Ecommerce fraud prevention software utilizes user behavior analysis to identify suspicious activities. By establishing a baseline of normal user behavior, the software can detect anomalies that deviate from the established patterns. For example, if a customer suddenly places an order from a different country using a new device and payment method, the software raises a red flag, prompting further investigation.

Risk Scoring and Decision Making

Fraud prevention software assigns risk scores to transactions based on various factors and indicators. These scores indicate the likelihood of a transaction being fraudulent. By setting specific risk thresholds, businesses can determine which transactions require manual review or additional authentication measures. This risk-based approach enables efficient decision making and ensures a balance between fraud prevention and customer experience.

Integration with External Data Sources

To enhance fraud detection accuracy, ecommerce fraud prevention software often integrates with external data sources. These sources can include credit bureaus, public records, device reputation databases, and global fraud networks. By accessing and analyzing additional information, the software gains a broader perspective on potential fraud activities, improving its ability to identify and prevent fraudulent transactions.

Collaboration and Data Sharing:

In the fight against ecommerce fraud, collaboration is key. Fraud prevention software facilitates information sharing and collaboration among merchants, payment processors, and other stakeholders. Through secure data sharing networks, businesses can pool their knowledge, share fraud trends, and collectively strengthen their defenses against fraudsters.

Conclusion

Ecommerce fraud prevention software is an indispensable tool in the modern

ecommerce landscape. By harnessing advanced technologies such as machine learning, artificial intelligence, and real-time transaction monitoring, this software helps businesses stay one step ahead of fraudsters. Through user behavior analysis, risk scoring, and integration with external data sources, it provides comprehensive protection against fraudulent activities.