Understanding Life Insurance Riders and Their Benefits

Life insurance is a crucial financial tool that provides protection and peace of mind to individuals and their loved ones. While a standard life insurance policy offers a death benefit, there are additional features known as riders that can enhance the coverage and customize the policy to suit specific needs. Understanding Life Insurance Riders and Their Benefits. In this article, we will explore the concept of life insurance riders, their benefits, and how they can provide valuable added protection to policyholders.

What are Life Insurance Riders?

Life insurance riders are optional provisions or add-ons to a base life insurance policy. They allow policyholders to expand the coverage and tailor the policy according to their unique circumstances and financial goals. Understanding Life Insurance Riders and Their Benefits. Riders offer a wide range of benefits that can address specific concerns such as terminal illness, disability, or the need for additional coverage in case of accidental death.

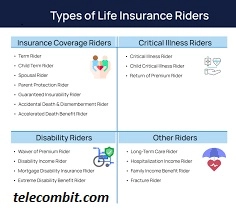

Types of Life Insurance Riders

- Accidental Death Benefit Rider: The Accidental Death Benefit Rider provides an additional death benefit if the insured dies as a result of an accident. This rider can be valuable for individuals engaged in high-risk professions or activities. It offers an extra layer of financial protection to the policyholder’s beneficiaries.

- Critical Illness Rider: A Critical Illness Rider provides a lump sum payment if the insured is diagnosed with a severe illness such as cancer, heart attack, or stroke. This rider can help cover medical expenses, loss of income, or other financial burdens that may arise during a critical illness. It provides financial support when it is needed the most.

- Disability Income Rider: The Disability Income Rider offers a regular income stream if the insured becomes disabled and is unable to work due to an accident or illness. This rider provides a percentage of the policy’s death benefit as monthly income, helping to replace lost wages and cover ongoing expenses during the disability period.

- Waiver of Premium Rider: The Waiver of Premium Rider ensures that the life insurance policy remains in force even if the insured becomes disabled and is unable to pay the premiums. This rider waives future premium payments, allowing the policyholder to maintain coverage without any financial strain during a difficult time.

Benefits of Life Insurance Riders

- Enhanced Protection: Life insurance riders expand the coverage of the base policy, providing additional financial protection against specific risks. Whether it’s protecting against accidents, critical illnesses, or disabilities, riders offer a comprehensive safety net that ensures policyholders and their beneficiaries are well-protected.

- Tailored Coverage: Riders allow policyholders to customize their life insurance policies to align with their individual needs and circumstances. They provide the flexibility to address specific concerns or gaps in coverage, ensuring that the policy offers the most relevant benefits for the insured and their beneficiaries.

- Cost-Effective Solution: Opting for riders instead of separate insurance policies can be a cost-effective solution. By adding riders to a base policy, policyholders can enhance their coverage at a lower cost compared to purchasing multiple individual policies. This approach allows individuals to meet their insurance needs while optimizing their budget.

- Peace of Mind: Life insurance riders provide peace of mind by addressing potential risks and uncertainties. With the added protection and benefits, policyholders can have confidence knowing that their loved ones will be financially secure in the face of unexpected events. Riders offer an extra layer of assurance during challenging times.

You can also learn about: Buying Wholesale Packaging Boxes

Conclusion

Life insurance riders offer valuable benefits that enhance the coverage and flexibility of a life insurance policy. By providing tailored protection against accidents, critical illnesses, disabilities, and more, these riders ensure that individuals and their beneficiaries are well-prepared for life’s uncertainties. Whether it’s customizing coverage or adding extra protection, life insurance riders are a valuable tool for securing financial peace of mind. Before choosing any specific rider, it is important to consult with a trusted insurance professional to understand.