Are You Self-Employed? Understanding How to Pay Yourself for More Efficiency

Being self-employed comes with many advantages, but it also brings the responsibility of managing your own finances, including paying yourself. Efficiently paying yourself is crucial to maintaining a stable income and maximizing your earnings. In this article, we will explore the essential strategies and considerations for self-employed individuals when it comes to paying themselves. Are You Self-Employed? Understanding How to Pay Yourself for More Efficiency. By understanding the options available and implementing the right approach, you can ensure financial stability and optimize your earnings.

The Importance of Paying Yourself

As a self-employed individual, paying yourself is not just a matter of convenience but an essential step in managing your personal finances effectively. Are You Self-Employed? Understanding How to Strategically Use Hashtags on Twitter for Businesses. By establishing a formal process, you separate your personal and business finances, which helps with budgeting, tax obligations, and financial planning. Paying yourself consistently also provides clarity on your earnings, making it easier to track your financial progress and set realistic goals.

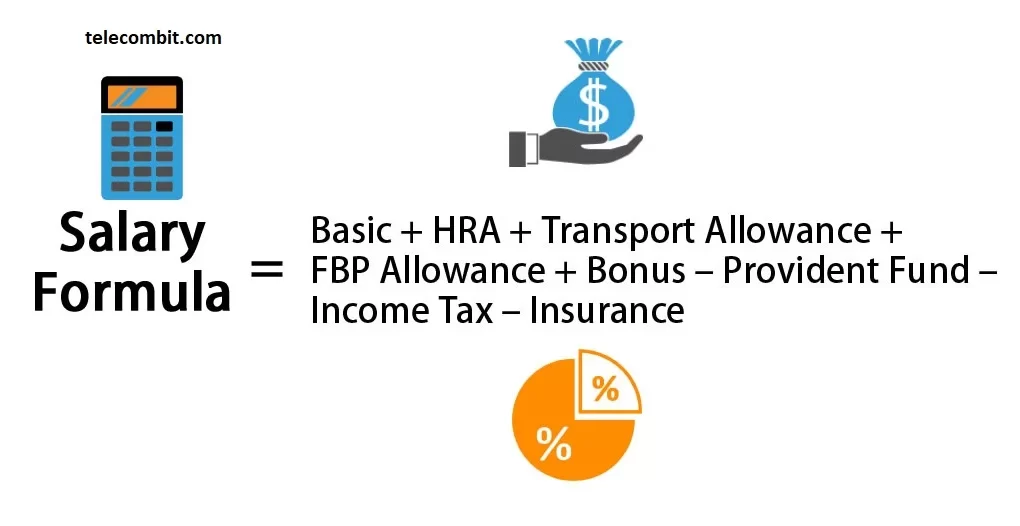

Determining Your Salary

One of the crucial aspects of paying yourself as a self-employed individual is determining your salary. It’s essential to strike a balance between paying yourself enough to cover personal expenses while leaving sufficient funds within the business for reinvestment and growth. Consider factors such as your living costs, business profits, industry standards, and market conditions when deciding on an appropriate salary for yourself.

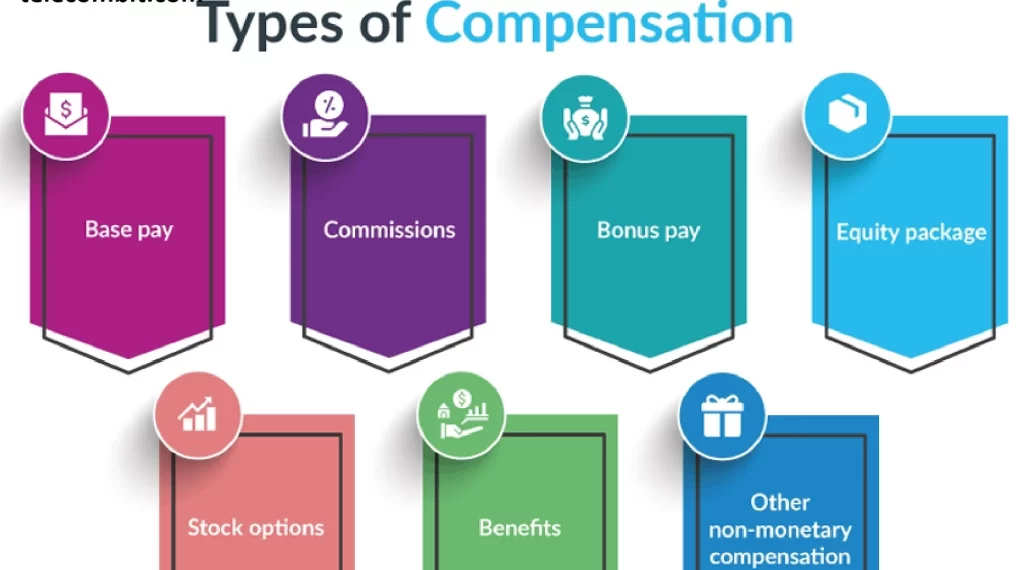

Types of Compensation

Self-employed individuals have various options for compensating themselves. The most common methods include owner’s draws, salary, and dividends. Owner’s draws involve taking money directly from the business account for personal use. Salary involves setting up a formal payroll system where you pay yourself a regular wage. Dividends are payments made to shareholders based on the business’s profits. Each method has its advantages and tax implications, so it’s crucial to consult with a tax professional to determine the most suitable approach for your circumstances or Car Dealership Marketing Agency: Driving Success in the Automotive Industry.

Tax Considerations

When it comes to paying yourself as a self-employed individual, understanding the tax implications is vital. If you pay yourself a salary, you need to account for payroll taxes, such as Social Security and Medicare taxes. Dividends may have different tax treatment depending on your business structure. Additionally, staying organized and keeping accurate records of your income and expenses is crucial for proper tax reporting. Consider working with a qualified accountant or tax advisor to ensure compliance and maximize your tax benefits.

Establishing a Payroll System

To streamline your self-payment process, it is recommended to establish a formal payroll system. This system will help ensure consistency, proper tax withholding, and accurate record-keeping. Research payroll software options tailored to self-employed individuals and small businesses. These tools often provide features like automatic tax calculations, direct deposit, and tax form generation. Implementing a payroll system will not only save you time and effort but also enhance your professionalism and financial management.

You can also learn about: Getting Into With Jetted Bathtub

Setting Aside for Taxes and Retirement

As a self-employed individual, it’s essential to set aside a portion of your earnings for taxes and retirement. Unlike traditional employment, where taxes are automatically deducted from your paycheck, self-employed individuals are responsible for their tax payments. It’s advisable to estimate your tax obligations and regularly set aside funds to avoid surprises come tax time. Additionally, explore retirement savings options for the self-employed, such as SEP-IRAs or Solo 401(k) plans, which offer tax advantages and help secure your financial future.

Seeking Professional Advice

Managing your finances as a self-employed individual can be complex, and seeking professional advice is highly recommended. A qualified accountant or financial advisor can provide invaluable guidance tailored to your specific circumstances. They can assist in structuring your compensation strategy, optimizing your tax situation, and ensuring compliance with relevant regulations. Investing in professional advice will help you make informed financial decisions and maximize your overall efficiency.

Conclusion

As a self-employed individual, understanding how to pay yourself efficiently is crucial for maintaining financial stability and maximizing your earnings. By determining an appropriate salary, exploring different compensation methods, considering tax implications, establishing a payroll system, and prioritizing tax and retirement savings, you can effectively manage your personal finances. Remember to seek professional advice from accountants or financial advisors who can provide tailored guidance for your specific situation. By implementing these strategies and taking a proactive approach to paying yourself, you can ensure financial efficiency and set yourself up for long-term success as a self-employed professional.