Flutterwave Scandal: Unveiling the Truth Behind the Controversy

In recent months, the financial technology industry has been rocked by a scandal involving Flutterwave, a prominent player in the African payment processing market. Flutterwave Scandal: Unveiling the Truth Behind the Controversy. Allegations of misconduct and questionable business practices have surfaced, leaving many users and industry experts wondering about the truth behind the controversy. In this article, we will delve into the details, examining the facts, claims, and implications surrounding the Flutterwave scandal.

The Rise of Flutterwave

Flutterwave, founded in 2016 by Nigerian entrepreneur Olugbenga Agboola, quickly gained recognition as a leading payment solution provider in Africa. The company aimed to bridge the gap in cross-border transactions and facilitate seamless payments across the continent. With its user-friendly interface, extensive payment options, and partnerships with major financial institutions, Flutterwave attracted a considerable user base and secured significant investments.

The Scandal Unfolds

The Flutterwave scandal emerged when several whistleblowers and disgruntled users came forward with claims of fraudulent activities and unethical conduct. The allegations ranged from mishandling customer funds to deceptive business practices, putting a dent in Flutterwave’s reputation as a reliable payment processor.

You can also learn about: Innovative and Successful Companies

Customer Fund Mismanagement

One of the primary allegations against Flutterwave is the mishandling of customer funds. It is claimed that the company used customer deposits for purposes other than processing payments, leading to delayed or incomplete transactions. Such mismanagement raised concerns about the security of users’ funds and the company’s financial stability.

Deceptive Business Practices

Another aspect of the controversy involves accusations of deceptive business practices. Critics argue that Flutterwave failed to provide transparent pricing, concealed hidden fees, and imposed unreasonable restrictions on users. These alleged practices raised questions about the company’s commitment to fair and ethical business conduct.

Legal and Regulatory Concerns

The Flutterwave scandal also drew attention to potential legal and regulatory issues. Whistleblowers claimed that the company operated in violation of financial regulations, such as inadequate anti-money laundering measures and insufficient Know Your Customer (KYC) protocols. If proven true, these allegations could have significant legal ramifications for Flutterwave, impacting its operations and standing in the industry.

Response from Flutterwave

In response to the allegations, Flutterwave issued a public statement acknowledging the concerns raised by users and promising a thorough investigation. The company emphasized its commitment to maintaining the trust and confidence of its customers, pledging to address any issues identified during the investigation. Flutterwave also stated its willingness to cooperate with regulatory authorities to ensure compliance with applicable laws.

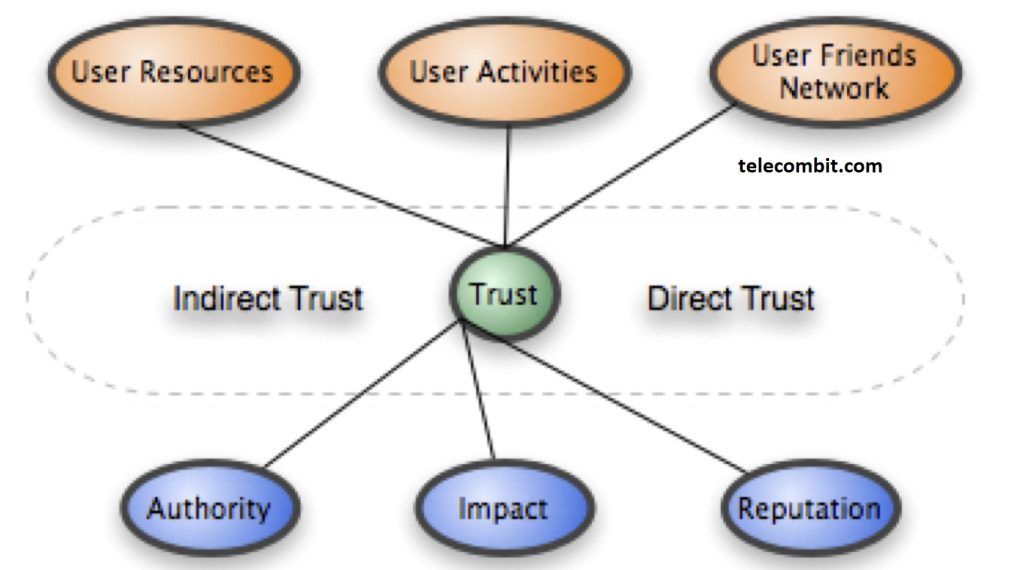

Industry Implications and User Trust

The Flutterwave scandal has undoubtedly had far-reaching implications for the financial technology industry in Africa. Users and businesses relying on Flutterwave’s services have expressed concerns about the security and reliability of the platform, leading to a loss of trust. Competitors have seized this opportunity to attract disgruntled users, further intensifying the competition in the market.

Conclusion

The Flutterwave scandal has shaken the African financial technology industry, raising serious questions about the company’s practices and integrity. While the truth behind the controversy is yet to be fully unveiled, the allegations of customer fund mismanagement and deceptive business practices have cast a shadow on Flutterwave’s reputation. As the investigation unfolds and regulatory authorities weigh in, it remains to be seen how Flutterwave will address the claims and regain the trust of its users.