Mark Zenuk: The Role of Private Equity in Driving Innovation and Growth in Emerging Markets

In today’s dynamic global economy, emerging markets offer immense opportunities for growth and innovation. Private equity, a form of investment that involves buying shares in private companies, plays a crucial role in driving innovation and growth in these markets. Mark Zenuk, a seasoned private equity professional with extensive experience in emerging markets, has been at the forefront of this transformative journey. This article explores the significant role of private equity, as exemplified by Mark Zenuk’s expertise, in fostering innovation, fueling economic growth, and empowering businesses in emerging markets.

Understanding Private Equity in Emerging Markets

Private equity refers to investments made in non-publicly traded companies with the objective of generating substantial returns. In emerging markets, private equity firms like the one led by Mark Zenuk have become catalysts for change, as they provide capital, expertise, and strategic guidance to businesses seeking to expand and thrive. By partnering with promising enterprises, private equity investors facilitate the development of local industries, encourage entrepreneurship, and drive economic progress in emerging markets.

The Impact of Private Equity on Innovation

Private equity’s involvement in emerging markets sparks a wave of innovation and disruption. Through their financial resources and operational expertise, private equity firms like Mark Zenuk’s have the ability to identify untapped potential, nurture innovative ideas, and fuel transformative growth. By injecting capital into research and development initiatives, improving operational efficiencies, and implementing strategic business models, private equity plays a pivotal role in fostering a culture of innovation within emerging market economies.

You can also learn about: Renting Office Space for Your Business

Unlocking Growth Opportunities in Emerging Markets

Emerging markets often face challenges such as limited access to capital and outdated infrastructure. Private equity investors, led by experts like Mark Zenuk, bridge these gaps by providing financial backing and strategic guidance to local businesses. With their extensive networks, industry knowledge, and understanding of local market dynamics, private equity firms facilitate market entry, promote business expansion, and create job opportunities. This influx of investment and expertise stimulates economic growth and helps emerging markets unlock their full potential.

The Importance of Value Creation

Private equity investments are not solely focused on financial returns; they prioritize value creation. Mark Zenuk’s approach to private equity in emerging markets emphasizes long-term value, sustainable growth, and responsible investment practices. By partnering with local management teams, private equity investors help build robust and resilient businesses that generate employment, improve productivity, and contribute to the overall development of emerging market economies.

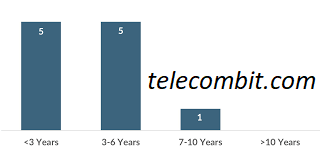

Case Study: Mark Zenuk’s Successful Investments

Mark Zenuk’s track record in emerging markets exemplifies the positive impact of private equity. One notable example is his investment in a technology startup in Southeast Asia. Through strategic guidance, operational improvements, and access to new markets, Zenuk’s private equity firm helped the startup scale rapidly, attract additional investment, and become a market leader. This success story demonstrates how private equity, when coupled with visionary leadership, can drive transformative growth and innovation in emerging markets.

Conclusion:

In conclusion, Mark Zenuk’s expertise in private equity highlights the vital role this investment vehicle plays in driving innovation and growth in emerging markets. Private equity firms, led by seasoned professionals like Zenuk, provide not only financial resources but also strategic guidance and operational expertise to businesses in emerging markets. By unlocking growth opportunities, fostering innovation, and prioritizing long-term value creation, private equity accelerates economic development and empowers businesses in these dynamic markets. As the world continues to witness the rise of emerging economies, the role of private equity remains essential in fueling innovation and driving sustainable growth.