The Power of Compound Interest in Your 401(k)

Harnessing the power of compound interest within your 401(k) retirement plan can be a game-changer for your financial future. Understanding how compound interest works and optimizing its potential can significantly boost your retirement savings. In this article, we will delve into the concept of compound interest, its impact on your 401(k) savings, strategies to maximize its benefits, and real-life examples that highlight its long-term potential.

The Basics of Compound Interest

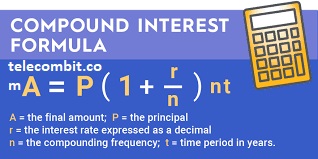

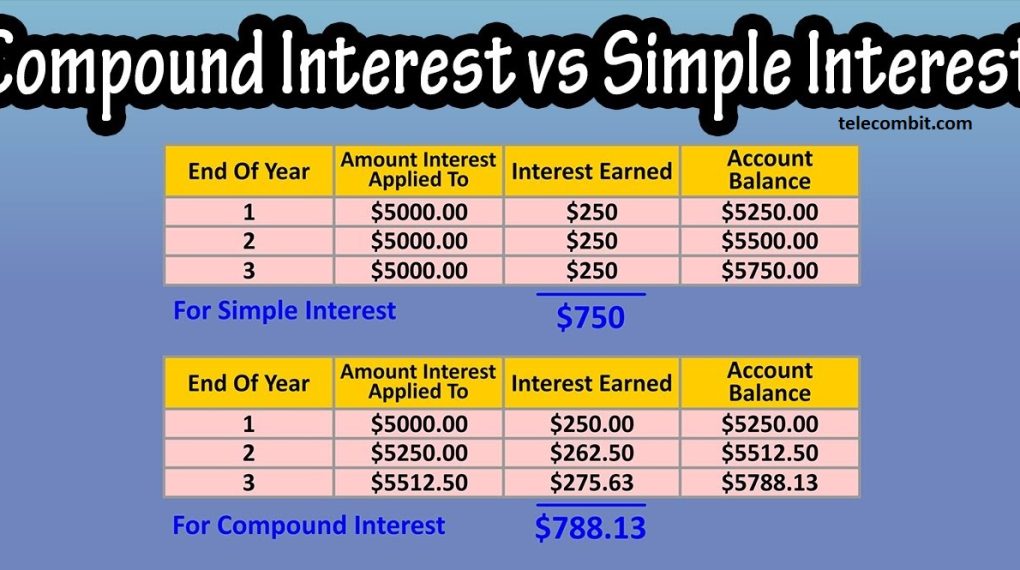

Compound interest is the concept of earning interest on both the initial investment and the accumulated interest over time. Unlike simple interest, which only calculates interest based on the initial investment, compound interest allows your money to grow exponentially. By reinvesting the interest earned, your savings can experience accelerated growth, creating a compounding effect that can multiply your wealth over the long term.

The Role of Compound Interest in Your 401(k)

Your 401(k) retirement plan is an ideal vehicle for harnessing the power of compound interest. Through regular contributions from your paycheck and potential employer matching, your retirement savings grow over time. The beauty of compound interest is that it enables your 401(k) to generate returns not only on your contributions but also on the accumulated interest, magnifying the growth potential.

You can also learn about: ASUS ZenBook Pro UX550

Maximizing Compound Interest in Your 401(k)

- Start Early: Time is a crucial factor in maximizing the benefits of compound interest. The earlier you start contributing to your 401(k), the longer your investments have to grow. Even small contributions made early on can accumulate significantly over several decades.

- Consistent Contributions: Regular and consistent contributions to your 401(k) are essential for reaping the full benefits of compound interest. Set up automatic contributions from your paycheck to ensure a disciplined savings approach.

- Take Advantage of Employer Matching: If your employer offers a matching contribution to your 401(k), strive to contribute at least the maximum matching amount. This is essentially free money that compounds over time, significantly enhancing your retirement savings.

- Optimize Investment Allocation: Diversify your 401(k) investments across various asset classes to manage risk while aiming for higher returns. Consult with a financial advisor or use online tools to determine an appropriate investment mix based on your risk tolerance and retirement goals.

The Impact of Compound Interest Over Time

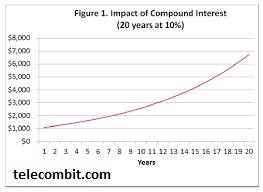

To illustrate the power of compound interest, let’s consider an example. Assuming an average annual return of 7% on a 401(k) balance, an individual who starts contributing $500 per month at age 25 could accumulate approximately $1.2 million by age 65, while their total contributions would only be around $240,000. This remarkable growth is primarily driven by the compounding effect of reinvesting the interest earned over 40 years.

Compound Interest vs. Simple Interest

It’s crucial to understand the stark difference between compound interest and simple interest. While simple interest grows at a linear rate, compound interest accelerates exponentially. By harnessing the power of compound interest, your 401(k) savings can outpace inflation and potentially provide a comfortable retirement nest egg.

Real-Life Examples of Compound Interest in Action

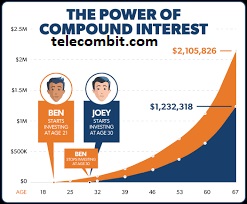

Let’s explore a few real-life examples that demonstrate the impact of compound interest on retirement savings. Imagine two individuals, John and Sarah. John starts contributing to his 401(k) at age 25, while Sarah starts at age 35. Despite both contributing the same amount each month, John’s early start gives him a significant advantage due to the extra years of compounding. By the time they both reach age 65, John’s 401(k) balance has grown substantially larger than Sarah’s, even though they contributed the same amount overall.

Conclusion

The power of compound interest within your 401(k) cannot be underestimated. By starting early, making consistent contributions, and allowing your investments to compound over time, you can potentially accumulate a substantial retirement nest egg. Understanding the mechanics of compound interest, optimizing your investment allocation, and staying invested for the long term are key strategies for maximizing the benefits of compound interest. By harnessing this power, you can pave the way for a financially secure future. Start leveraging compound interest in your 401(k) today and set yourself on the path to a comfortable retirement.