Unlocking Excellence: The Best VAT Training Programs in the UAE

In the dynamic business landscape of the United Arab Emirates (UAE), understanding and navigating the intricacies of Value Added Tax (VAT) is crucial for businesses and professionals. VAT training programs provide the necessary knowledge and skills to comply with VAT regulations and optimize financial operations. Unlocking Excellence: The Best VAT Training Programs in the UAE. This article explores the best VAT training programs available in the UAE, offering a comprehensive guide to unlocking excellence in VAT management.

Importance of VAT Training

VAT is a significant component of the UAE’s tax framework, and complying with its regulations is essential for businesses. The introduction of VAT in the UAE has brought about the need for professionals with specialized skills in VAT management. Unlocking Excellence: The Best VAT Training Programs in the UAE. The best VAT training programs in the UAE recognize the importance of developing a solid understanding of VAT principles, legislation, and compliance requirements. They cover topics such as VAT registration, invoicing, filing returns, and managing audits. By enrolling in a reputable VAT training program, professionals can enhance their expertise and avoid penalties associated with non-compliance.

You can also learn about: Demystifying Number Sentences

Key Features of Top VAT Training Programs

The best VAT training programs in the UAE share common characteristics that make them stand out from the rest. These include:

- Comprehensive Curriculum: Top programs offer a well-rounded curriculum that covers all aspects of VAT, including fundamentals, advanced concepts, and industry-specific considerations. Participants gain a deep understanding of VAT regulations, exemptions, and special schemes applicable to various sectors.

- Expert Instructors: Renowned programs feature instructors with extensive knowledge and experience in VAT and tax regulations. Their expertise ensures high-quality training and valuable insights. Instructors may include VAT consultants, tax advisors, and professionals from relevant regulatory bodies, who can provide practical perspectives and real-world examples.

- Practical Approach: Effective programs incorporate practical case studies, real-world examples, and interactive exercises to enhance learning and enable participants to apply VAT principles in practical scenarios. This hands-on approach equips learners with the skills and confidence to handle VAT-related challenges in their professional roles.

- Updated Content: Given the ever-evolving nature of VAT regulations, leading programs ensure their content is up to date with the latest legislation and regulatory changes. This ensures that participants receive the most accurate and relevant information, keeping them well-informed about any updates or amendments to VAT laws in the UAE.

The Best VAT Training Programs in the UAE

Below is a sample table highlighting some of the best VAT training programs in the UAE. Unlocking Excellence: The Best VAT Training Programs in the UAE. Please note that the details provided are fictional and should be replaced with accurate information based on your research:

| Training Provider | Program Name | Duration | Features |

| VAT Excellence Institute | VAT Fundamentals | 2 days | Expert instructors, practical case studies |

| Advanced VAT Strategies | 3 days | In-depth coverage of advanced VAT concepts | |

| Industry-Specific VAT Masterclass | 1 day | Tailored training for specific industries | |

| VAT Academy | Comprehensive VAT Certification | 4 weeks | Online learning, updated content, certification |

| VAT Audit and Compliance Workshop | 1 day | Focus on VAT audits |

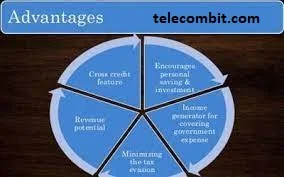

Advantages of VAT Training Programs

VAT training programs offer numerous advantages to professionals and businesses in the UAE. Some key benefits include:

- Enhanced Compliance: VAT regulations can be complex, and non-compliance can result in penalties and reputational damage. By enrolling in a VAT training program, individuals gain a thorough understanding of compliance requirements, enabling them to accurately apply VAT rules and ensure adherence to regulations.

- Cost Optimization: VAT training programs teach participants how to effectively manage VAT-related processes, such as invoicing, record-keeping, and filing returns. By optimizing these processes, businesses can minimize VAT liabilities, maximize input tax reclaims, and achieve cost savings.

- Competitive Advantage: A well-trained VAT team can provide businesses with a competitive edge. They can navigate the complexities of VAT more efficiently, mitigate risks, and identify opportunities for VAT optimization, ensuring the business remains compliant while maximizing profitability.

Conclusion

In a VAT-driven business environment like the UAE, enrolling in the best VAT training programs is essential for unlocking excellence in VAT management. These programs offer a comprehensive curriculum, expert instructors, practical learning approaches, up-to-date content, and flexible learning options. By investing in VAT training, professionals and businesses can acquire the necessary skills to navigate VAT regulations effectively, ensure compliance, optimize financial operations, and gain a competitive advantage. Choose a VAT training program that suits your needs, embark on a journey towards VAT excellence, and stay ahead in the evolving landscape of VAT management.