A Beginner’s Guide to Understanding the Requirements for an FHA Loan

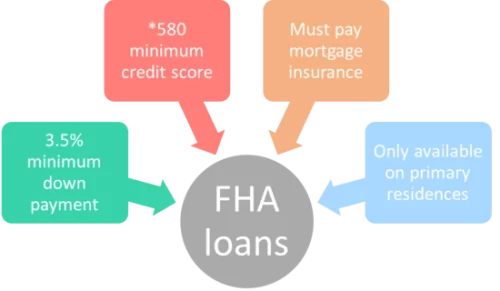

According to the U.S. Department of Housing and Urban Development (HUD), Federal Housing Administration (FHA) loans are mortgage loans insured by the FHA that are designed to make homeownership a reality for first-time buyers and those with limited incomes or credit history.

If you’re a first-time homebuyer, the FHA loan program can help you secure a lower down payment and easier credit requirements. FHA loans are available for single-family homes, multi-family dwellings, and manufactured homes.

In this article, we’ll discuss the requirements for an FHA loan and how you can qualify. We will also cover the different types of FHA loans and the pros and cons of getting one.

Eligibility Requirements

To qualify for an FHA loan, you must meet certain criteria set by HUD:

- You must have a steady employment history or worked for the same employer for the past two years

- You must have a valid Social Security number, lawful residency in the U.S., and be of legal age to sign a mortgage in your state

- Your credit score must be at least 500 (though some lenders may require a higher score).

- You must have a minimum 3.5% down payment

- Your debt-to-income ratio must be 43% or less

The Different Types of FHA Loans Available

There are several types of FHA loans, each with its benefits and drawbacks. Some of the more popular loan options include:

- FHA 203(b): This loan is for those who are purchasing a single-family home and need financing for the purchase. It also applies to certain multi-family homes as long as they are not used for investment purposes.

- FHA 203(k): This loan is designed to help borrowers finance purchasing and rehabilitating a single-family home or multi-family dwelling. It can be used to purchase or refinance an existing home.

- FHA Streamline Refinancing: This loan is meant to help existing FHA borrowers lower their interest rate and/or monthly payments. It does not require income verification or an appraisal, but you must have already had an FHA-insured mortgage for at least six months to qualify.

You can also learn about: Michele Tecchia Transformed Monaco

Benefits of Refinancing with an FHA Loan

Refinancing your mortgage with an FHA loan can offer many advantages. A few of the benefits include:

- Lower interest rates

- Reduced monthly payments

- Ability to consolidate debt or avoid foreclosure

- Low closing costs

- Flexible guidelines for qualifying

In addition, you may be able to qualify for an FHA mortgage even if you don’t have perfect credit or a large down payment.

Finding the Right Mortgage Lender

Now that you understand the requirements for an FHA loan, the next step is to find a lender who can help you with the application process. It is important to note that not all mortgage lenders offer FHA loans, so it’s important to do your research and find a lender who specializes in this type of loan.

When looking for an FHA mortgage lender, make sure you look at their interest rates, fees, and eligibility requirements. It’s also a good idea to read reviews about the lender to determine if they can be trusted and if they are experienced in handling FHA loan applications.

With a better understanding of the requirements for an FHA loan, you can now explore the option of applying for one to make your dreams of homeownership a reality. A qualified FHA mortgage lender will be able to provide all the information you need about the application process and eligibility requirements. With the right lender, you can be on your way to owning a home in no time!

Do you have more questions about FHA loans? Contact us today and we’ll be happy to answer any questions you have!