Authority of Bitcoin: Should Buy And Hold BTC In Lengthy Term

A hurricane has brought the planet’s first and numerous well-known cryptocurrencies since its beginning. With its decentralized character, restricted pool, and potential for significant recoveries, Bitcoin has caught the attention of investors worldwide. Authority Of Bitcoin: Why You Should Buy And Hold BTC In The Lengthy Term. This paper examines why you should think about purchasing and storing Bitcoin long-term, taking benefit of its strength and prospect as an extreme digital asset.

Comprehending Bitcoin

Digital gold as we know it today is Bitcoin, a decentralised digital cash that operates on a peer-to-peer grid called the blockchain. Built-in 2009 by an unknown individual or company understood as Satoshi Nakamoto, Bitcoin presents a fast, OK, and firm way to share and store value without mediators such as pools or management.

Bitcoin’s Recorded Interpretation

Bitcoin’s recorded interpretation has been zero short of fantastic. Since its start, Bitcoin has undergone significant prices beating even the most promising anticipations. Despite periodic volatility, its long-term direction has been upward, creating it one of the best-performing buys of the last decade.

Bitcoin as a Store of Value

One of the fundamental causes to buy Bitcoin is attaining traction as a long-term asset is its possibility to act as a mart of value. Unlike conventional fiat money, which can be subject to inflation and devaluation, Bitcoin has a fixed pool of 21 million cash. These wants and decentralized qualities make Bitcoin an appealing vote for people aiming to save their assets and maintain buying energy over time.

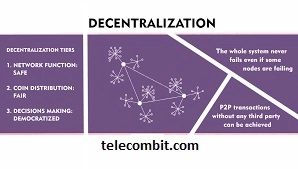

Decentralisation and Safety

Bitcoin’s decentralized nature and robust safety protocols are essential factors that donate to its strength and stability. Bitcoin’s blockchain support push for censorship-proof, checkable, and irreversible trades. Bitcoin’s goodness and reliability are supported by the decentralized character of the web’s nodes, which contain any single body from exercising control over or using the system.

International Acceptance and Adoption

Bitcoin has gained general approval and adoption globally. Leading corporations, financial organizations, and even countries increasingly recognize its legality and integrate it into their processes. This growing approval fuels the need to buy Bitcoin, also hardening its part as a valuable and practical digital support.

Prospect for Future Growth

While Bitcoin has already undergone considerable change, many professionals believe its possibility for future preference stays essential. As more someones and organizations identify and support Bitcoin’s value offer, the market for Bitcoin will likely grow. Also, the ongoing results in infrastructure, laws, and financial outcomes associated with Bitcoin make a favorable view for its long-term development prospect.

Long-Term Investment Strategy

When considering accepting Bitcoin as a long-term asset, it is essential to create a well-thought-out plan. Here are some basic principles to keep in mind:

Tolerance and HODLing: Bitcoin’s long-term win is often attributed to the process of “HODLing” (holding onto Bitcoin for a long time). By assuming a patient and disciplined strategy, investors can ride out short-term cost changes and help from the possible long-term evolution of Bitcoin also read The Importance of Business Software in the Airline Industry.

Safe Storage: Given the digital heart of Bitcoin, it’s important to prioritize the safety of your holdings. Utilize safe wallets, such as hardware or offline warehouse answers, to protect your Bitcoin from cyber threats.

Danger Elements to Consider

While Bitcoin offers considerable potential, it’s important to recognize and consider the associated hazards. Some key risk elements include:

Volatility: Before you buy Bitcoin, you should understand that costs can be positively explosive, sharing significant short-term changes. Investors must be designed for this volatility and keep a long-term view to guide the ups and downs of the need.

Regulatory Territory: The regulatory terrain covering Bitcoin and cryptocurrencies is still growing. Restriction differences can affect the need view and impact the value and legitimacy of Bitcoin assets. Staying scholarly about regulatory actions is required.

Safety Risks :While the underlying blockchain technology is fast, personal investors must be careful about watching their Bitcoin holdings. Cybersecurity threats like hacking and phishing episodes can risk personal wallets and relations.

Conclusion

Bitcoin’s power as a transformative digital support is absolute. Its possibility as a long-term asset lies in its capacity to act as a shop of worth, its decentralized core, and its global approval. While dangers live, a well-informed and strategic direction, connected with a long-term perspective, can place investors to profit from Bitcoin’s development and possible coming value.