Mastering the Income Tax Calculator: The Essential Guide to Estimating Your Tax Liability

Understanding how to estimate your tax liability is crucial for effective financial planning. The income tax calculator is a powerful tool that helps individuals and businesses determine their tax obligations accurately. Mastering the Income Tax Calculator: The Essential Guide to Estimating Your Tax Liability. In this comprehensive guide, we will delve into the details of mastering the income tax calculator, providing you with the essential knowledge and step-by-step instructions to estimate your tax liability accurately.

Importance of Estimating Tax Liability

Estimating your tax liability is essential for several reasons. It enables you to plan your finances effectively, budget for tax payments, and avoid any unexpected tax burdens. Mastering the Income Tax Calculator: The Essential Guide to Estimating Your Tax Liability. By using an income tax calculator, you can gain a clear understanding of your tax obligations, which allows you to make informed financial decisions and take advantage of any available tax-saving strategies.

Understanding Income Tax Basics

Before using an income tax calculator, it’s crucial to have a basic understanding of income tax concepts. Familiarize yourself with terms such as taxable income, deductions, tax brackets, and credits. Understanding these fundamental concepts will help you navigate the tax calculator more effectively and accurately estimate your tax liability.

Gathering the Necessary Information

To use the income tax calculator successfully, gather all the relevant financial information, including your income sources, deductions, and credits. Collect your W-2 forms, 1099 forms, and any other income-related documents. Make a list of deductible expenses, such as mortgage interest, and also How to Transition to a Natural Skincare Routine: Tips and Tricks, charitable contributions, and medical expenses. Mastering the Income Tax Calculator: The Essential Guide to Estimating Your Tax Liability. Having all the necessary information at hand ensures accurate results when using the tax calculator.

Choosing the Right Income Tax Calculator

There are various income tax calculators available online, ranging from simple calculators to more advanced ones that consider multiple tax scenarios. Choose a calculator that aligns with your tax situation, whether you are an individual taxpayer, a freelancer, or a business owner. Mastering the Income Tax Calculator: The Essential Guide to Estimating Your Tax Liability. Opt for reliable and reputable tax calculators to ensure accurate calculations and up-to-date tax laws.

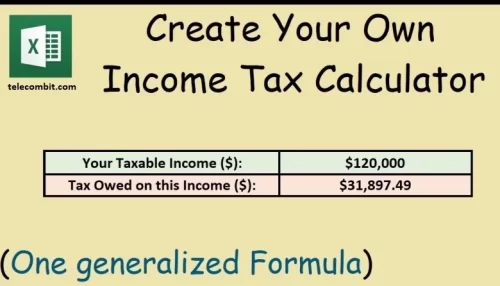

Step-by-Step Guide to Using the Income Tax Calculator

- Enter your filing status: Select the appropriate filing status, such as single, married filing jointly, or head of household.

- Enter your income: Input your income from all sources, including wages, self-employment income, rental income, and investments.

- Deductions and credits: Enter any applicable deductions and credits, such as student loan interest, child tax credits, or mortgage interest deductions.

- Review the results: The calculator will generate an estimate of your tax liability. Review the results carefully, ensuring accuracy and verifying that all relevant information has been included.

- Make adjustments if necessary: If you anticipate changes in your income or deductions, adjust the inputs accordingly to see how they impact your tax liability.

Understanding the Results and Next Steps

Once you have estimated your tax liability using the income tax calculator, it’s essential to understand the results. If you anticipate owing taxes, consider adjusting your tax withholding or making estimated tax payments to avoid penalties. If you expect a tax refund, plan how to utilize it wisely, such as paying off debt or saving for future expenses.

Conclusion

Mastering the income tax calculator is a valuable skill that empowers individuals and businesses to estimate their tax liability accurately. By understanding income tax basics, gathering the necessary information, choosing the right calculator, and following a step-by-step process to use the calculator, you can gain valuable insights into your tax obligations and make informed financial decisions. Remember to review the results carefully and understand the implications of your estimated tax liability.