Putting A Price On Value: Understanding Valuation Service

When it comes to determining the worth of an asset, valuation services play a crucial role. Whether it’s for financial reporting, investment analysis, or transactions, understanding the value of an asset is essential for making informed decisions. In this article, we will delve into the world of valuation services, exploring their significance, the methods used, and the factors that influence valuation outcomes. Putting A Price On Value: Understanding Valuation Service.

The Significance of Valuation Services

Valuation services provide a comprehensive and objective assessment of an asset’s value. They are crucial in various scenarios, such as:

- Financial Reporting:

- Valuations are essential for financial reporting purposes, including fair value measurements and impairment testing.

- Accurate and reliable valuations ensure that financial statements reflect the true value of assets and liabilities.

- Mergers and Acquisitions:

- Valuations play a vital role in mergers and acquisitions, helping parties determine a fair purchase price and negotiate effectively.

- A thorough valuation analysis considers factors such as market conditions, future earnings potential, and synergistic effects.

- Investment Analysis:

- Investors rely on valuations to assess investment opportunities, estimate potential returns, and evaluate risk.

- By understanding the value of an asset, investors can make informed decisions and allocate their capital effectively.

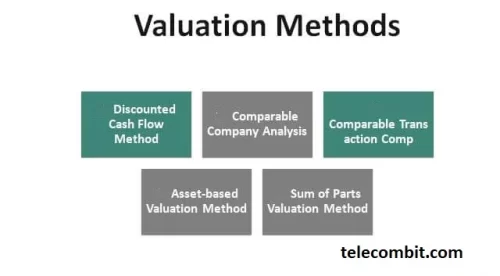

Methods Used in Valuation Services

Valuation professionals employ various methods to determine the value of an asset. Some common approaches include:

- Market Approach:

- This approach involves comparing the asset to similar assets that have been recently sold or are actively traded in the market.

- By analyzing comparable transactions and market multiples, the valuator can derive an indication of value.

- Income Approach:

- The income approach focuses on the future income or cash flow generated by the asset.

- Valuators use methods such as discounted cash flow (DCF) analysis to estimate the present value of future cash flows.

- Cost Approach:

- The cost approach determines value based on the cost required to replace or reproduce the asset.

- It considers factors such as the asset’s current condition, replacement cost, and depreciation.

Also Read: sell Bitcoin in Dubai?

Factors Influencing Valuation Outcomes

Several factors can influence the outcome of a valuation. These include:

- Market Conditions:

- Valuations can be influenced by market volatility, supply and demand dynamics, and prevailing economic conditions.

- Changes in market conditions can affect the perceived value of an asset.

- Industry and Sector Factors:

- Industry-specific trends, growth prospects, and competitive landscapes can impact valuation outcomes.

- Valuators consider these factors when assessing an asset’s value within its industry context.

- Financial Performance:

- The financial performance of a company or asset, including revenue, profitability, and growth potential, can significantly influence valuation results.

- Historical financial data and future projections are considered during the valuation process.

- Intangible Assets:

- Valuing intangible assets, such as intellectual property, brands, or customer relationships, requires specialized approaches and considerations.

- Factors like brand reputation, market dominance, and patent portfolios contribute to the overall value.

Conclusion

Valuation services are instrumental in determining the value of assets for various purposes. Whether it’s for financial reporting, investment analysis, or mergers and acquisitions, accurate and reliable valuations are essential. By employing methods such as the market approach, income approach, and cost approach, valuers can assess an asset’s value from different angles. However, it’s important to consider factors that can influence valuation outcomes, such as market conditions, industry factors, financial performance, and the presence of intangible assets.