Ways to use RPA in finance

In the fast-paced world of finance, staying ahead of the competition requires embracing innovative technologies. Robotic Process Automation (RPA) has emerged as a game-changer, revolutionizing the way financial institutions operate. By automating mundane and repetitive tasks, RPA frees up valuable time for finance professionals to focus on strategic initiatives. In this article, we will delve into seven powerful ways to leverage RPA in finance, enabling increased efficiency, accuracy, and cost savings.

Enhancing Regulatory Compliance and Risk Management

Compliance with ever-evolving regulations is a critical aspect of the financial industry. RPA enables organizations to stay compliant by automating data collection, validation, and reporting processes. Bots can monitor regulatory changes, extract relevant information, and update compliance frameworks accordingly. Moreover, RPA can streamline Know Your Customer (KYC) processes, reducing the risk of fraudulent activities and enhancing due diligence procedures.

When hiring a CPA tax accountant, consider their qualifications, experience, references, and fees. Ensure they have expertise in your specific tax needs, whether for business or personal finances.

Accelerating Financial Reporting and Analysis

Financial reporting and analysis involve intensive data gathering and analysis, which can be time-consuming and error-prone. RPA can automate data extraction from various sources, such as spreadsheets, databases, and external systems. Bots can then perform data cleansing, validation, and consolidation, significantly reducing reporting cycle times. By automating routine analysis tasks, RPA allows finance professionals to focus on interpreting data and generating actionable insights.

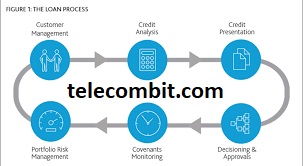

Optimizing Loan Processing and Underwriting

The loan processing and underwriting stages in financial institutions often involve repetitive tasks, manual data entry, and extensive documentation. RPA can automate loan origination, credit scoring, and document verification processes. Bots can retrieve applicant data, perform credit checks, and validate documents, ensuring compliance and minimizing processing time. By streamlining these processes, financial institutions can enhance customer experience and accelerate loan approvals.

Improving Fraud Detection and Prevention

Fraud is a pervasive threat in the financial sector, requiring continuous monitoring and proactive measures. RPA can play a vital role in fraud detection and prevention by analyzing large volumes of transactional data. Bots can identify patterns, anomalies, and suspicious activities in real-time, triggering alerts for further investigation. By automating fraud detection processes, financial institutions can enhance security measures, mitigate risks, and protect both their reputation and customer trust.

Automating Reconciliation and Settlement

Reconciliation and settlement processes are critical for maintaining accurate financial records and ensuring timely transactions. RPA can automate reconciliation tasks by comparing data from multiple sources, such as bank statements, payment systems, and internal records. Bots can identify discrepancies, flag exceptions, and initiate corrective actions, reducing manual efforts and minimizing errors. By automating these processes, financial institutions can improve operational efficiency and optimize cash flow management.

Enhancing Customer Service and Support

Delivering exceptional customer service is a priority for financial institutions. RPA can enhance customer service and support by automating routine inquiries, account updates, and transactional processes. Bots can handle customer requests, provide real-time balance updates, and process account changes, freeing up customer service representatives to handle complex inquiries. This automation not only improves customer satisfaction but also enables round-the-clock support.

Conclusion

The implementation of RPA in finance opens up a world of possibilities for streamlining operations and transforming the way financial institutions function. By leveraging RPA, organizations can streamline accounts payable and receivable processes, enhance regulatory compliance and risk management, accelerate financial reporting and analysis, optimize loan processing and underwriting, improve fraud detection and prevention, automate reconciliation and settlement, and enhance customer service and support.