Exploring the Potential Tax Savings through ERC for Small Businesses

When it comes to managing finances, small businesses are always on the lookout for opportunities to save money. One often overlooked avenue for tax savings is the Employee Retention Credit (ERC). This valuable tax incentive, introduced in response to the COVID-19 pandemic, offers small businesses the potential to save significant amounts on their tax liabilities. In this article, we will delve into the world of ERC and explore how small businesses can leverage it to maximize their tax savings.

Understanding the Employee Retention Credit (ERC)

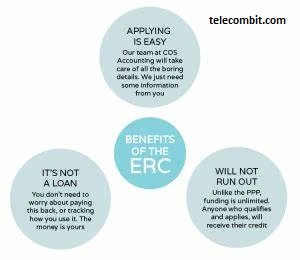

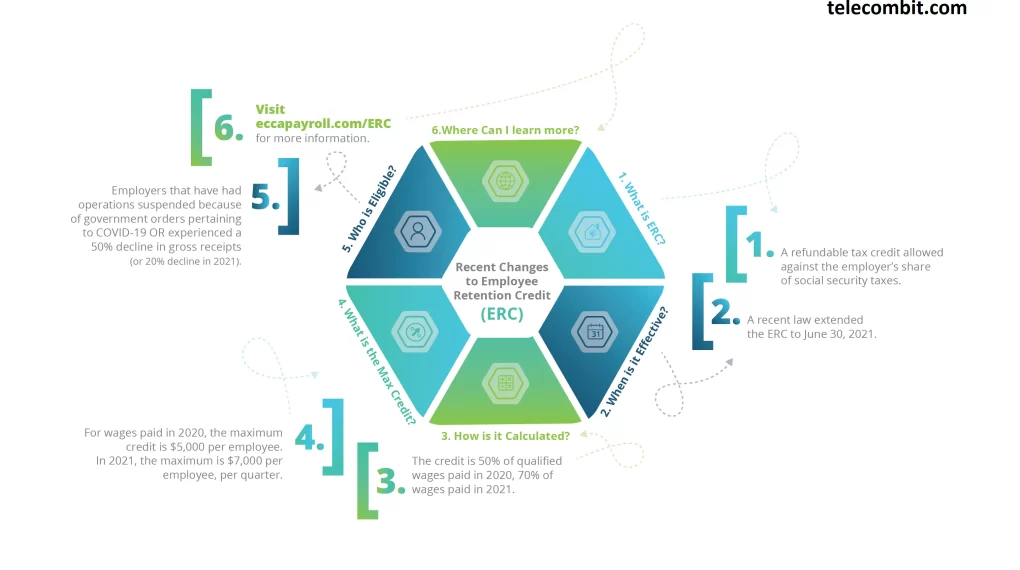

The Employee Retention Credit is a tax credit designed to encourage businesses, including small businesses, to retain employees during challenging times. Initially introduced as part of the CARES Act in 2020 and extended through subsequent legislation, the ERC provides eligible employers with a tax credit based on qualified wages paid to eligible employees. This credit can result in substantial tax savings for small businesses.

Qualifying for the Employee Retention Credit

To qualify for the ERC, small businesses must meet certain criteria. Generally, eligible employers include those who experienced a significant decline in gross receipts or were subject to government-imposed shutdowns during specified quarters. Additionally, businesses with 100 or fewer full-time employees may claim the credit on all employee wages, and also Are Beautyforever Human Hair Wigs Right For You? while those with more than 100 employees can claim it on wages paid to employees who were not providing services due to specific circumstances.

Calculating the Tax Savings

The ERC can result in substantial tax savings for eligible small businesses. The credit amount is calculated as a percentage of qualified wages paid to eligible employees during the specified periods. For 2021 and 2022, the credit rate is up to 70% of qualified wages, with a maximum credit per employee per quarter. By carefully evaluating and documenting qualified wages, small businesses can optimize their tax savings and potentially reduce their overall tax liabilities.

Maximizing the Employee Retention Credit

Small businesses can take several steps to maximize the potential tax savings through the ERC. It is crucial to thoroughly understand the eligibility requirements and ensure compliance with documentation and reporting obligations. Consulting with a tax professional or utilizing specialized software can help navigate the complexities of the ERC and identify all eligible tax credits. By staying up-to-date with legislative changes and maximizing qualified wages, small businesses can make the most of this tax incentive.

Conclusion

Small businesses can significantly benefit from the Employee Retention Credit as a means to reduce their tax liabilities and improve their financial position. By understanding the intricacies of the ERC, ensuring eligibility, and maximizing qualified wages, small businesses can unlock substantial tax savings. It is essential to consult with tax professionals or leverage specialized software to navigate the complexities of this tax incentive effectively. So, explore the potential of the Employee Retention Credit and take advantage of the tax savings it offers to boost your small business’s financial health.