How being money-smart can help you tackle inflation

Inflation is an economic phenomenon that affects the purchasing power of individuals and erodes the value of money over time. To navigate the challenges posed by inflation, it is essential to be money-smart and adopt effective strategies to protect and grow your wealth. How being money-smart can help you tackle inflation. This article explores key principles and actionable tips to help you tackle inflation head-on and secure your financial future.

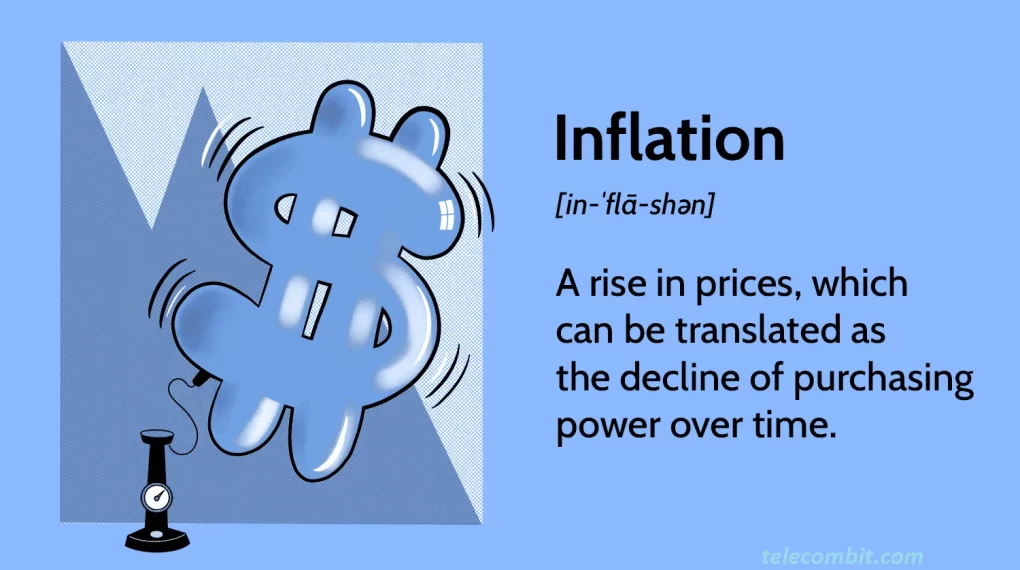

Understanding Inflation and Its Impact

Inflation refers to the sustained increase in the general price level of goods and services over time. It diminishes the purchasing power of money, meaning that the same amount of currency buys less than it used to. Inflation can impact various aspects of our lives, including the cost of goods, housing, education, and healthcare. How being money-smart can help you tackle inflation .Being aware of inflation’s impact is the first step towards becoming money-smart.

Also Read: Life Insurance Riders and Their Benefits

Building a Strong Financial Foundation

To tackle inflation effectively, it is crucial to establish a strong financial foundation. This involves creating an emergency fund to cover unexpected expenses and avoiding high-interest debt. By minimizing financial risks and securing a solid financial base, you can better withstand the effects of inflation and maintain stability during economic fluctuations.

Diversifying Your Investments

Investing wisely is a key strategy for combating inflation. One way to mitigate the impact of inflation on your investments is to diversify your portfolio. Spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, can help reduce the risk associated with inflation. By diversifying, you increase the chances of earning returns that outpace inflation over the long term.

Making Informed Spending Decisions

In an inflationary environment, making informed spending decisions becomes crucial. It is essential to prioritize needs over wants and evaluate purchases based on their long-term value. Practicing frugality and avoiding unnecessary expenses can help you save money and counteract the effects of inflation. Additionally, comparing prices, seeking discounts, and being a mindful consumer can stretch your budget further in the face of rising prices.

Utilizing Tax-Advantaged Accounts

Tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, provide valuable benefits for combating inflation. By taking advantage of these accounts, you can contribute pre-tax income, potentially lowering your taxable income and allowing your investments to grow tax-free or tax-deferred. This strategy helps preserve more of your money and maximize its potential to outpace inflation.

Embracing Long-Term Financial Planning

Inflation is a long-term concern, and combating it requires a similarly long-term approach. Creating a comprehensive financial plan that aligns with your goals and accounts for inflation is essential. This plan should include saving for retirement, investing in assets with potential for growth, and regularly reviewing and adjusting your financial strategy. A long-term perspective allows you to stay ahead of inflation and build a resilient financial future.

Keeping an Eye on Interest Rates

Interest rates play a vital role in managing inflation. When inflation rises, central banks often respond by increasing interest rates. Monitoring these interest rate movements is crucial, as it affects borrowing costs, investment returns, and the overall economy. By staying informed about interest rate changes and adjusting your financial decisions accordingly, you can make informed choices that help counteract the effects of inflation.

Staying Informed and Seeking Professional Advice

Staying informed about economic trends and financial strategies is vital for navigating inflation effectively. Educate yourself about inflation, investment opportunities, and personal finance through reliable sources. Additionally, consider seeking advice from financial professionals who can provide personalized guidance based on your unique circumstances. Their expertise can help you make sound financial decisions and stay on track towards your goals.

Conclusion

Inflation is an economic reality that affects everyone’s financial well-being. By adopting money-smart practices, such as building a strong financial foundation, diversifying investments, making informed spending decisions, utilizing tax-advantaged accounts, embracing long-term planning, monitoring interest rates, and staying informed, you can effectively tackle the challenges posed by inflation. Remember, staying proactive, informed, and adaptable is the key to protecting and growing your wealth in the face of inflation’s impact.