How Does the Debt Snowball Method Work?

Dealing with debt can be overwhelming, but there are effective strategies to regain control of your finances. One such method is the debt snowball method. In this article, we’ll explore how the debt snowball method works and how it can help you pay off your debts efficiently. How Does the Debt Snowball Method Work? By following a step-by-step approach and leveraging the power of psychology, the debt snowball method offers a practical solution for becoming debt-free. Let’s dive in!

Understanding the Debt Snowball Method

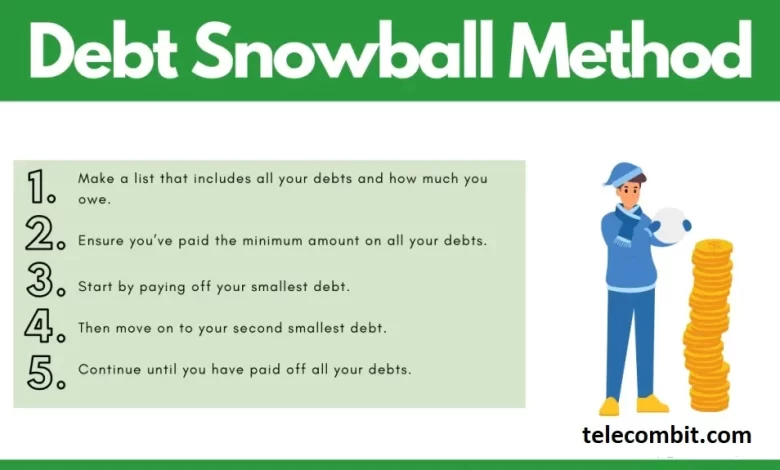

The debt snowball method is a debt repayment strategy that focuses on paying off debts in a specific order, regardless of interest rates. It involves listing your debts from smallest to largest and tackling them in that order. How Does the Debt Snowball Method Work? The key idea behind this method is to build momentum and motivation by experiencing quick wins, which helps keep you motivated throughout the debt repayment journey.

Creating a Debt Repayment Plan

To get started with the debt snowball method, create a comprehensive list of all your debts. Include the outstanding balance, minimum monthly payment, and the creditor’s name for each debt. How Does the Debt Snowball Method Work? Next, arrange the list in ascending order based on the outstanding balance. This order will determine the sequence in which you’ll pay off your debts.

Allocating Extra Payments

In the debt snowball method, you make the minimum payments on all your debts except the one with the smallest balance. For that debt, you allocate any extra money you can afford to pay. How Does the Debt Snowball Method Work? This could be from cutting back on discretionary expenses or increasing your income through side gigs. By channeling extra payments towards the smallest debt, you accelerate its repayment and build positive momentum.

Celebrating Quick Wins

As you pay off the smallest debt, celebrate your accomplishment. This celebration, however small, plays a vital role in reinforcing your commitment and keeping you motivated. It’s essential to acknowledge and appreciate the progress you’ve made, no matter how modest it may seem. How Does the Debt Snowball Method Work? This positive reinforcement encourages you to stay on track with the debt snowball method.

Rolling Over Payments

Once you’ve paid off the smallest debt, take the money you were allocating towards it and apply it to the next debt on your list. This is where the snowball effect comes into play. The amount you were paying towards the first debt becomes an additional payment for the second debt. How Does the Debt Snowball Method Work? As a result, your repayment power gradually increases with each debt you pay off, accelerating your progress.

Scaling Up for Larger Debts

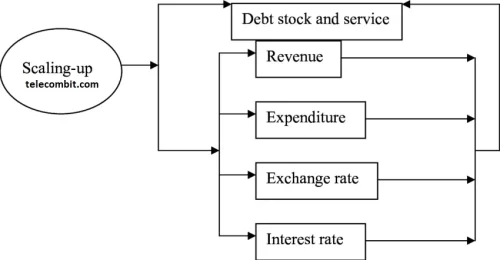

As you move on to larger debts, you’ll have more money available to allocate towards their repayment. The process repeats itself: you pay the minimum on all debts except the one with the smallest balance, and any extra funds go towards that debt. How Does the Debt Snowball Method Work? This systematic approach ensures that you maintain momentum and continue working towards debt freedom.

You can also learn about: Improve Your Business’s Performance?

Benefits of the Debt Snowball Method

One of the significant advantages of the debt snowball method is the psychological boost it provides. How Does the Debt Snowball Method Work? By paying off smaller debts first, you experience a sense of accomplishment, which fuels your determination to tackle larger debts. Additionally, the method simplifies your debt repayment plan, making it easier to manage and stay motivated.

Conclusion

The debt snowball method is a powerful tool for individuals striving to overcome debt. By prioritizing small victories and leveraging the psychological impact of quick wins, this method helps build momentum and maintain motivation throughout the repayment process. Remember to create a comprehensive debt repayment plan, allocate extra payments strategically, and celebrate each milestone along the way. With perseverance and the debt snowball method, you can regain.