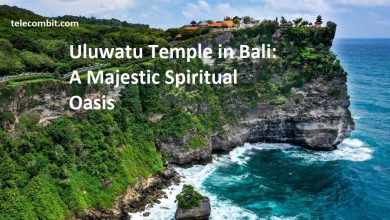

PSD2 Compliance: Effects and Solutions for Payment Acceptance

In the ever-evolving world of digital payments, staying compliant with regulations is crucial for businesses. The Revised Payment Services Directive (PSD2) is a significant regulatory framework that has transformed the payment landscape across the European Union (EU). This article explores the effects of PSD2 compliance on payment acceptance and provides solutions for businesses to navigate this regulatory landscape effectively.

Effects of PSD2 Compliance on Payment Acceptance

Enhanced Security Measures

Under PSD2, Strong Customer Authentication (SCA) has become a mandatory requirement for most electronic transactions. This means that businesses must implement two-factor authentication, such as biometrics or one-time passwords, to ensure secure payment acceptance. While these security measures offer enhanced protection against fraud, they can introduce additional friction in the payment process, potentially affecting user experience. Therefore, it is crucial for businesses to strike a balance between security and user convenience by adopting authentication methods that are both secure and user-friendly.

Increased Competition and Innovation

PSD2 also promotes open banking, allowing third-party providers (TPPs) to access customers’ account information with their consent. This provision fosters competition and encourages innovation in the payment industry. By granting TPPs access to customer data, businesses can leverage this opportunity by partnering with them to offer value-added services and create seamless payment experiences for their customers. For instance, businesses can collaborate with TPPs to provide personalized financial management tools, account aggregation services, or even innovative payment methods that enhance the overall customer experience.

Impact on Payment Service Providers (PSPs)

Payment Service Providers play a crucial role in facilitating transactions between merchants and consumers. With PSD2, PSPs face increased regulatory obligations and must obtain the necessary licenses to continue operating. This regulatory scrutiny ensures that PSPs meet stringent security standards, enhancing trust and confidence in the payment ecosystem. PSPs need to invest in robust security infrastructure, conduct regular security audits, and maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS) to ensure the protection of sensitive customer information.

Converting real estate prospects into sales involves using winning scripts that communicate value, address objections, and build trust to guide potential buyers through the sales process successfully.

Changes in Payment Authorization

PSD2 introduces a new concept known as Payment Initiation Services (PIS), allowing consumers to authorize payments directly from their bank accounts. This shifts the traditional payment landscape by bypassing card networks and enabling direct bank transfers. Businesses need to adapt their payment acceptance systems to accommodate this change by integrating PIS capabilities. By doing so, they can offer customers more payment options, streamline the payment process, and potentially reduce transaction costs associated with traditional card payments.

Solutions for Effective PSD2 Compliance

Implementing Strong Customer Authentication (SCA)

To comply with PSD2’s SCA requirements, businesses need to implement robust authentication mechanisms. This involves integrating biometric authentication methods, tokenization, and secure one-time passwords into their payment systems. By adopting these measures, businesses can strike a balance between security and user experience, ensuring seamless payment acceptance. It is also essential to educate customers about the benefits of SCA and guide them through the authentication process to minimize confusion and enhance user acceptance.

Adopting Secure Third-Party Providers (TPPs)

Collaborating with trusted Third-Party Providers can offer businesses innovative payment solutions while ensuring compliance with PSD2. By integrating with established TPPs, businesses can leverage their expertise in open banking and provide customers with a wider range of services, such as account aggregation and personalized financial management tools. However, businesses should carefully evaluate the reputation and security practices of TPPs before partnering with them to ensure data protection and maintain customer trust.

Investing in Fraud Prevention Solutions

As PSD2 aims to reduce payment fraud, businesses should invest in advanced fraud prevention solutions. These solutions employ artificial intelligence and machine learning algorithms to detect and prevent fraudulent activities in real-time. By analyzing various data points, such as transaction patterns, device information, and user behavior, these systems can identify suspicious activities and trigger additional authentication measures when necessary. By implementing robust fraud prevention measures, businesses can protect their customers’ data and mitigate financial risks.

Educating Customers and Staff

PSD2 compliance involves changes in the payment process, security measures, and the role of TPPs. It is essential for businesses to educate their customers about these changes and reassure them about the security enhancements. Clear communication, FAQs, and user guides can help customers understand the new authentication procedures and the benefits of PSD2 compliance. Moreover, businesses should also provide training and information sessions for their staff to ensure they are well-equipped to handle customer queries related to PSD2 compliance.

Regular Security Audits and Compliance Monitoring

o maintain PSD2 compliance, businesses must conduct regular security audits and monitor their systems for any vulnerabilities. This involves performing penetration testing, vulnerability assessments, and code reviews to identify and address potential security weaknesses. Additionally, businesses should stay updated with the latest security standards and guidelines issued by regulatory authorities to ensure ongoing compliance. By implementing a proactive approach to security and compliance, businesses can minimize the risk of data breaches and regulatory penalties.

Collaboration with Regulatory Bodies and Industry Associations

Staying updated with evolving regulations and industry best practices is crucial for businesses aiming to achieve PSD2 compliance. Collaborating with regulatory bodies and industry associations can provide valuable insights and guidance on compliance requirements. Participation in industry forums and conferences can also offer networking opportunities and allow businesses to stay informed about emerging trends and technologies in the payment acceptance landscape.

Conclusion

PSD2 compliance brings both challenges and opportunities for businesses in the realm of payment acceptance. By embracing the enhanced security measures, leveraging the potential of open banking through TPP partnerships, and investing in fraud prevention solutions, businesses can navigate the regulatory landscape effectively while offering secure and seamless payment experiences to their customers. Additionally, by educating customers, conducting regular security audits, and collaborating with regulatory bodies, businesses can ensure ongoing compliance and stay at the forefront of the evolving payment industry.