Self-Directed IRA Real Estate: How to Evaluate and Mitigate Risk

Self-directed Individual Retirement Accounts (IRAs) offer investors the opportunity to diversify their retirement portfolios by investing in real estate. While this can be an appealing option, it’s important to understand and evaluate the associated risks. In this article, we will explore the ins and outs of self-directed IRA real estate investments. Self-Directed IRA Real Estate: How to Evaluate and Mitigate Risk. By understanding how to evaluate and mitigate risk effectively, you can make informed decisions and maximize the potential benefits of this investment strategy.

Understanding Self-Directed IRAs and Real Estate Investments

Before delving into the evaluation and risk mitigation process, it’s crucial to grasp the fundamentals of self-directed IRAs and real estate investments. Self-directed IRAs provide individuals with the flexibility to invest in a wide range of assets, including real estate properties such as residential homes, commercial buildings, or even raw land. This allows investors to diversify their retirement portfolios beyond traditional stocks, bonds, and mutual funds.

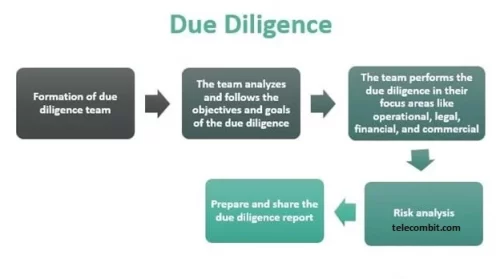

Conducting Thorough Due Diligence

When considering a self-directed IRA real estate investment, conducting thorough due diligence is paramount. Research and gather information about the property, its location, market trends, and potential income-generating opportunities. Evaluate factors such as rental demand, vacancy rates, and property appreciation potential. Self-Directed IRA Real Estate: How to Evaluate and Mitigate Risk. Consider working with real estate professionals or experts who can provide valuable insights and guidance throughout the evaluation process.

You can also learn about: Successful Trading Career

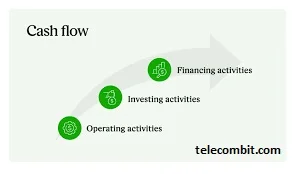

Assessing Financial Considerations and Cash Flow Potential

Evaluate the financial considerations associated with the investment. Assess the purchase price, financing options, property taxes, insurance, and ongoing maintenance costs. Determine the potential cash flow from rental income and compare it to expenses. Conducting a detailed financial analysis will help you gauge the investment’s profitability and long-term viability. Ensure that the investment aligns with your retirement goals and risk tolerance.

Understanding Legal and Compliance Requirements

Navigating the legal and compliance aspects of self-directed IRA real estate investments is crucial. Familiarize yourself with IRS guidelines and regulations surrounding these investments. Ensure that the investment structure complies with self-directed IRA rules and that you follow the required procedures for transactions, documentation, and also Greta Van Fleet Net Worth, Career, Age, Height & Weight, FAQ , and record-keeping. Self-Directed IRA Real Estate: How to Evaluate and Mitigate Risk. Consulting with a qualified tax professional or financial advisor specializing in self-directed IRAs can provide valuable guidance in this regard.

Mitigating Risk through Proper Asset Management

Effective risk mitigation involves proper asset management throughout the investment lifecycle. Develop a comprehensive asset management plan that includes regular property inspections, maintenance, and tenant screening procedures. Establish contingency plans for unforeseen circumstances such as property damage, tenant turnover, or market fluctuations. Self-Directed IRA Real Estate: How to Evaluate and Mitigate Risk. By actively managing the investment and addressing potential risks promptly, you can protect your retirement funds and optimize returns.

Diversification and Portfolio Allocation

Diversification is a key strategy in mitigating risk in any investment portfolio, including self-directed IRA real estate investments. Consider diversifying your self-directed IRA by including other asset classes such as stocks, bonds, or precious metals. Self-Directed IRA Real Estate: How to Evaluate and Mitigate Risk. This can help spread risk and reduce exposure to any single investment. Analyze your overall retirement portfolio and allocate assets strategically based on your risk tolerance and investment objectives.

Conclusion

Self-directed IRA real estate investments can provide an avenue for diversification and potential growth within your retirement portfolio. However, it’s crucial to approach these investments with careful evaluation and risk mitigation strategies. By conducting thorough due diligence, assessing financial considerations, understanding legal requirements, implementing proper asset management practices, and diversifying your portfolio, you can navigate the potential risks and maximize the benefits of self-directed IRA real estate investments. Remember to consult with financial professionals to ensure that your investment aligns with your long-term retirement goals and risk tolerance.